Option-ARMs...FINALLY making the news!

The image to the left is from this WSG Online article about my favorite 'bubble' loan...the option ARM mortgage. This is the loan with 4 payment options and that all enticing introductory 1% (or similar) payment. You can see my post here for more info about the loan.

Like every tool, this loan has it's place for informed borrowers, or sophisticated borrowers that are trying to manage their cash flow. The problem is that since there is such a disconnect between income and housing prices (especially California), you have people using these mortgages as a way to 'afford' their property. The problem with making that minimum payment is that the difference between that payment, and what the interest only payment would have been, gets tacked on the back of your loan in the form of 'negative amortization'.

Quick example. Say the minimum payment on a 400k loan is $1200, and the interest only payment is $2200. If you made the minimum payment, then your loan balance would be 401k after one month. Then you would be paying interest on your deferred interest...can you say FUN! So, as you can imagine, like many people do with their credit cards, they make the minimum payment.

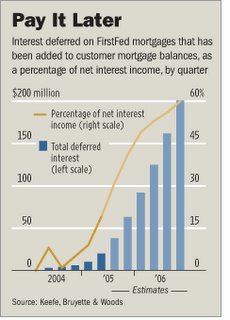

I think this statistic from the article is very telling: "the amount of interest that customers are rolling into their mortgage balances -- known as "negative amortization" -- rose $25 million in the fourth quarter to $63 million for the year, up from $6 million a year earlier".

YIKES! What does that tell you!?!?? People can't afford their mortgages. If they could, they would make at least the interest only payment. A 10-fold increase in deferred interest in 1 year!

"Another way to look at it is as a percentage of income. Fully 51% of FirstFed's pretax income and 41% of its net interest income was from negative amortization in the fourth quarter." Looks like this negative amortization is a rather large part of their income. The banks are also saying "that their losses on option-ARM mortgages long have been minimal". I'm sure they are saying that! It is like the analogy I have used several times before. They are driving forward by looking out the back window. There hasn't been a real catalyst yet that causes things to get ugly. If property prices decline and/or the rates start going adjustible...watch out! But wait....it gets better!

"Moreover, over 80% of FirstFed's recent loans have been "low documentation" loans, meaning they required less confirmation about whether the customer was a good risk. Through the first nine months of last year, over 13% of its mortgages were NINAs -- "no income, no assets." In other words, customers get mortgages without disclosing their income and assets."

What I have been saying forever now!!! Not only are people getting option-ARM's, 80% aren't even fully documenting their income! Does anybody else see a problem here?!?!? I have been saying it here and on other blogs for many months now. I know some of you will be all worked up about the NINA loans. The thing with NINA'a is that you need a top notch fico score, and the are usually done at lower loan-to-values, than the other loans. Those people are usually putting down 20-40% in cash, so as bad as they sound, I don't worry about them as much as the 80% of 'reduced doc' loans. Depending on the lender, reduced doc is the same as saying 'stated'.

The other thing I will add about these loans, is that they are the highest paying loans available for loan officers and brokers. Every lender is different, but it was pretty standard that if the loan officer 'sold' the borrower in the 3yr pre-pay, then they would get 3 rebate points on the back of the loan. This means the lender would pay the broker 15,000 on a 500k loan. The "good" brokers would often tell the borrower "I can get you that 1% loan, but the only way I can do it is if you pay 1-point up front, and take a 3yr pre-pay penalty. That is the 'only' way I can get you that super low 1% payment!" It is amazing how many people would fall for this line. If you are cringing right now, I feel you. You just paid some loan officer who called you on the phone, $20,000 to do your loan, plus any other fees. You paid 1pt up front, and the lender paid them 3 points on the back. It would make me sick to know I paid some 'kid' 20k for my loan. I bet 20k would pay off most people's car payments right now...or pay off their credit card bills. The thing is, you can get an option ARM with no pre-pay penalty, and the 1% rate...it just doesn't pay a rebate on the back end. Sell a little pre-pay...make a lot of money. See how easy that is!?!?

I look forward to the comments!

SoCalMtgGuy

25 Comments:

This is indicative of the crunch that many have predicted would happen. The Usatoday had an article yesterday on how people are having a hard time getting by with higher fuel and energy costs as well as the new BK law requirements that have doubled minimum credit card payments. This option-ARM loan with 4 payment options is just allowing a path of least resistance so these minimum card paying people can skate by.

I would bet that there will be all kinds of indicators coming out this month showing people struggling with their debt. Just for example the one wherer they track late paments on credit cards. These were already showing problems last year from the gas price hikes.

Not knowing much about the loan and mortgage business(I don't have a mortgage) what do you think will happen to the housing market in CA in 2006? How about other parts of the country as New England, AZ, FL?? Do you think the FED will let the housing bubble collapse? I think the FED will do everything in it's power to uphold housing prices as this is the only economy left in this country.

For those who didn't catch this in the Boston Globe earlier in the week:

HOUSING SLOWDOWN SQUEEZES BORROWERS

The number of foreclosure notices filed against Massachusetts homeowners last year reached their highest level since the housing bust of the early 1990s, as homeowners fell behind on their mortgages and lenders began the process of taking back the properties.

Paradoxically, the sudden halt to sharply rising home prices put a squeeze on many borrowers, analysts said. Homeowners who stretched their finances to the limit to buy a home found it more difficult to make their payments on variable-rate mortgages as interest rates rose, but they were less able to refinance their loans at more attractive rates or sell and pay off their debts because the value of their homes fell or remained flat. "When prices are skyrocketing, you have the option" of selling the house for a gain or refinancing, said Nicolas Retsinas, director of the Joint Center for Housing Studies at Harvard University.

"In an economy where price appreciation is more modest or doesn't exist, what option do you have left?" he said. "Sadly, one of those options is foreclosure."

Last year, there were almost 11,500 foreclosure filings in Mas sachusetts Land Court, where most notices are filed by banks and mortgage companies against the homeowners, according to ForeclosuresMass Corp., which compiles and tracks filings. That is a 32 percent increase from 2004, pushing the number of filings on record to its highest level since 1993, when a once-booming housing market was in a tailspin. The biggest increases were in Eastern Massachusetts.

During the housing boom of 1999 to 2004, the average price of Massachusetts houses and condominiums surged by at least 10 percent every year except one, putting the state's home-price appreciation among the nation's highest. But last year, price gains slowed to 5 percent, and single-family home prices were flat or even declined in some Boston and suburban neighborhoods.

"There's an epidemic of foreclosures," said Boston lawyer Gary Klein, who represents borrowers in lawsuits against lenders. "We're getting a steady stream of referrals of people who are looking for any option to save their home."

Jeremy Shapiro, president of ForeclosuresMass, predicted filings would rise again this year, because many homeowners with adjustable-rate mortgages will see their monthly payments begin to rise along with interest rates.

"As we get into '06, '07, '08 and beyond, we're going to see more folks whose rates adjust," he said.

When notice is filed, it typically takes a mortgage lender three to four months to complete the foreclosure process and seize the property. Only about one in three filings actually results in a bank or mortgage company taking ownership of the home, but they provide a gauge of financial hardship.

The biggest spikes last year occurred in Essex County, north of Boston (up 48 percent), Barnstable County on Cape Cod (47 percent), Suffolk County (45 percent), and Bristol County (44 percent).

Divorce, separation, and job losses are the main reasons people lose their homes. While high-income individuals in divorce proceedings or spending beyond their means are vulnerable, working-class cities including Lynn and Worcester, where residents are more likely to live on a tight budget, were hardest hit last year. Also, people with poor credit ratings who qualify for mortgages from lenders charging high interest rates are also concentrated in these neighborhoods.

"People can't pay their mortgage," said Juan Ortega, a real estate agent in Lawrence in Essex County. "They're up to the top. They bought very high, and now they can't make the mortgages."

Lawrence's housing market surged with the rest of the state. But lately, said Ortega, a Century 21 agent, he is spending his time helping clients facing foreclosures, which seem particularly acute in one predominantly Latino neighborhood north of downtown Lawrence.

A rash of foreclosures can drive down property values in a neighborhood, as lending institutions that do not want to hold onto the houses drop the prices to sell them quickly.

In the winter of 2004, Susan Chamberlain lost her part-time job as an IRS tax examiner. She recently was rehired, full time, but that earlier layoff precipitated a November foreclosure filing. She and her husband, Kevin, initially purchased their Lawrence home for $158,000 in the spring of 2001 with US Veterans Affairs financing.

In December 2002, they refinanced and withdrew some money to pay off a car and some bills, bringing their mortgage debt to $206,000.

The interest rate on the new mortgage was variable, initially averaging 9 percent but rising since then.

With the Veterans Affairs loan, the Chamberlains paid $1,200 a month on their mortgage; their current monthly payment is $1,900.

In the Boston area, house prices are so high, Klein said, that mortgages consume a growing share of monthly take-home pay. "It used to be, if you lost a job you'd be at risk of losing the house," he said. "Now, if you lose overtime, many families are so close to the brink, and that can create problems."

Do I have this right? FirstFed isn't really getting more interest income, they are just declaring the additional 51% of accrued and compounded as yet unpaid neg-am interest as income?

Look at the trend not just the numbers. All of 2004 $6m, Q1-3 2005 $38m, Q4 2005 $25m. That's exponential. And I don't care what GAAP calls it, I wouldn't call this "income" until it actually starts getting paid.

Compound fracture! Kung Fu Death Grip! Deadly choke hold! THE ECONOMY IS DOOMED! Make preparations, save yourself!

My first thought was short the FirstFed. Then I realized that shorts only work when the markets work. This is not a functional market. I want loans that are neg-am to be reported as non-performing assets. A 30yr fixed where the borrower is paying less than the monthly interest is a non-performing loan. Why the heck are these any better? I also want any portion of a loan exposed to more than 75% LTV to be considered non-asset backed. Where are the bank examiners in all this?

"Where are the bank examiners in all this?"

The 'pro-business' Republican junta that controls the government has virtually eliminated any regulation or oversight. And not just in banking. The shit is going to hit the fan; I hope you all are doing what you can to prepare yourselves.

azgolfer,

No way!

Look at the option ARM loan. ALL of the 4 payments fluctuate. The payment is NOT a 30yr fixed, but a 30 yr amortized payment. If rates go up, they make more money.

But the big reason they can pay 3pts on the back is because they are going to make a killing on people using the neg-am feature. Not to mention that there is a 3yr pre-pay on the loans that pay 3 points on the back. The pre-pay is usually 6 months interest. On a 500k loan, that could easily be 12,000 or more.

Even if the borrower makes the I/O payment, after a few months, the bank will have made enough money to 'pay for' those 3 points. On a 500k loan, the bwr will have paid 15k to the lender in about 6-8 months...and they have a 3yr pre-pay.

There is nothing fancy with the 30yr fixed...no 'secret' places where lots of money can be made. Lots of people are going to get crunched with their option-ARMs the next 2-3 years. Remember, all 4 payments are tied to an index + some margin. If rates go up...all 4 payment choices go up.

I hope this helps clear some stuff up.

SoCalMtgGuy

mrincomestream

Did you catch my reply to your post on Ben's blog...the last post of the day yesterday on his site (WSJ -exotic loan problems)...about world savings?

SoCalMtgGuy

Karen,

I decided to leave Eastern Mass on April 1, 1983 (check the historical weather). Never looked back, dropped off my thesis and rode my motorcycle until I parked on the pier in Santa monica. Never ever regretted a second. Mass is losing population. Pretty soon the motto will be; "Home to the newly wed, nearly dead or deeply inbred." People don't even understand that the entire BosWash corridor in running on inertia. Were it not for the billions we pour into the OPACs (Obsolete Pre Automotive Cities) the collapse would be even faster. Boston and NYC are just the most insulated not immune. Draw circles out and see Pittsfield, Springfield, Worcester, Boston. Same for Buffalo to NYC. Some of us saw this 25 years ago and now we are millionares on the California Coast. That window is closed. Where next? Maybe RTP, maybeTuscon, maybe the Central Valley, maybe Austin (again). I can only hope that someplace learns and keeps taxes low and lending standards high.

Karen said...

"Home to the newly wed, nearly dead or deeply inbred."

Funny stuff. You're quite the comedian.

Thanks, I try real hard to keep people guessing whether I'm actually trying to be funny.

Anyway, there's a big difference twixt misled and unfortunate and what you call dumb. Dumb would be going into denial or trying to bargain or any of those other coping mechanisms. You are smart. thing of the costs of getting smarter as tuition. Montgomery and Loudon are D.C. poster children much like Santa Barbara and Orange County are the SoCal minions of the bubble gods.

I am truly sorry you cashed out of California. We need people like you to buffer the insanity. I am most impressed by your admission. I know dozens, yes dozens of people who cashed out. A very few are brave enough to say out loud that it may not have been the best choice. Make no mistake, this runs back to when some good friends of my wife's parents left 30 years ago in the mid 70s. They are still friends, they have regrets. Nothing new here.

You are so correct that the schools suck. There I said it. They suck. Take away local control, take away local funding, then take away suplemental funding and impose onerous non-educational demands and surprise, quality suffers. There are still a few districts left but the houses in them cost more than private tuition.

The only good news is that lending is about to change. Think treasurydirect.com for traditional home loan lending and eBy.com for transaction costs. both may each take Supreme Court review but both are coming.

Karen,

As long as we agree that most California primary and secondary schools are substandard. Not all. There still exist many "holdovers" from the age of superiority. They just cost so much in property taxes that they are phasing themselves out of existance. There is another bubble related issue here. Smart districts have set up dual track schools within schools. My oldest is in one such. All the core classes are "honors" track. Meaning good. In exchange her test scores keep them out of trouble for underperformance.

Don't worry about California despite all this. On the evil side we are sure to export our problems just as we exported our bounty. On the good side we are likely to export our tax views. Prop 13 and such.

mtnrunner2

1. I'd say it is more about integrity than anything 'illegal'

2. Easy, the 1% rate is the same up front, but there will be a higher 'margin' that is added to whatever 'index' (cofi, cosi, mta, etc) the loan is tied to. Don't forget the pre-pay penalty. Also, don't forget that even if the borrower makes the minimum payment, most lenders are 'counting it' like they got the profit of the I/O payment. The higher margin, and the pre-pay protect the lender for the large upfront payout.

3. I wouldn't worry about them defaulting on a CD at this time...or in the near future.

4. Very likely they could make 3-5k or more. Don't get me wrong, lots of people are still making lots of money...it all depends on the situation they are in. If you are 'new' and are just dialing for dollars, you better be burning up the phones all day, everyday. You will be able to make a living...it just gets old quickly. If you are at a company that has good referrals and better than average lead streams, then you can easily make 3-5k. The days of 'easy' 20-30k are over for many people.

How is that?!?!?

SoCalMtgGuy

Karen, as someone who will be moving to S.Calif this summer, I understand what you're saying. We lost 50K (yes, lost equity, not lost profit) on our home when we sold in Central Texas Nov'05. We're renting until the school year is out and then when we move, we'll rent or move in with my parents, as much as my wife would love to buy a home, she also knows we can't afford our own with the current market (we saw 2 dumps this Christmas listed for $550K and $660K).

As for schools, we're not worried since we have been homeschooling and will continue to do so.

My buddy just cashed out and sold his house in CA and moved to Virginia. He just told me he just bought another home that cost more. Bought in at the peak. Now he calls me and tells me he is not sure if he can afford it. He says theres a chance he might sell it later and move back. Hes afraid he wont be able to come back to CA. He cant even afford his old house. Obviously this guy didnt do his research. He should have traded down but like most people do, he got some cash in his pocket burning a hole and he traded up. He is in a bigger hole now.

Not all homeowners who bought low care if paper equity is lost. If we take a dive, who cares, its all paper equity. Even better with a 30yr fixed below 6%. My house is not an investment, its a home for my family. Not an ATM.

I agree with anonymous about losing paper equity and it being a home not an ATM. We bought a 2000 sq. ft. condo on logan circle in 1999 for 385k. I'm still decorating/upgrading the place and loving every minute. A significant drop in the market would give us a breather from the ever increasing taxes and allow us to buy a future retirement home via foreclosure sales.

Not all homeowners who bought low care if paper equity is lost.

Well, a lot do care, at least most of the homeowners I know. Currently, the level off theory is very popular during lunch breaks.

I agree with Karen's "A breather from the ever-increasing taxes"

I hope you're not counting on a decrease in property taxes if values drop. Not likely to happen.

Here in Texas, when the appraisals came down 2001 or 2002 they claimed that they had to raise the tax rates to keep paying for needed services.

Translation: no way are we going to fire city employees or cut our pay. Are you crazy?!?

Karen,

Thanks for the kind words!

That is EXACTLY what I was looking for....a place for good people to meet, and pass information!

I think you will like what I have in store here shortly....

SoCalMtgGuy

I've been a recovering mortgage banker for the past 10 years. These new creative lending practices have left me stunned. I've done California, I've done and am doing again Northern Virginia. When I first learned of how many I/Os were out there I was shocked. It was extremely rare that I'd do a true NINA loan "back in the day", let alone some of these more exotic loans. I have only very little exposure to sub-prime and what I did see I didn't like.

I'm arm-chairing this now as just a regular homeowner and observer. After the last downturn in California in the early 90s I got out and moved on.

I live in Fairfax County, near Dulles Airport. The new construction is unbelievable. Who are all these folks who can afford $700k townhomes? Or these "executive" homes on zero lots for $900k?? I'm all for some density building but do they all have to be this unaffordable crap?

I look around at my little 1400 sf dollhouse and say "well, at least it doesn't take long to clean." And I can afford it. So far. Tax assessements just made my payment $53/month more expensive. And, no ARMs in this household. After all my years in the "biz", if you can't qualify for a home on a 30-year fixed at 6.5%, you can't afford the damn house. 7% is a great rate in any market as far as I'm concerned and we haven't been there in years and people STILL need I/O loans?

Give me a break.

SoCalMtgGuy,

I enjoy reading your blog and I appreciate your candor regarding your industry.

But I do have to say that this business about the mortgage broker receiving a "3 point rebate" for selling the 3-year pre-payment penalty troubles me a little. Instead of "rebate", how about the term "kickback"? I recognize that the term "Kickback" has an unsavoy feel to it and no industry would want to be associated with the term. But isn't that what it amounts to? If the broker disclosed this fact to the lender (that he was receiving the "rebate"), in addition to all of the terms and ramifications of this loan, I don't think I would have a problem with it. But the idea that some brokers are taking advantage of their clients like this is really appalling. It seems very unethical and possibly illegal?

roadtripboy...

It is the 'lender' that pays the rebate. It is up to the broker/loan officer to determine the loan for the borrower.

I know some brokers that hate the option ARM. I know some that will only do it with the no pre-pay or the 1-yr (depending on the loan program). I also know brokers that live and die by the option arm. Selling it with 3 points back is the only way to go.

I hear you. Believe me I do. I'm just telling you what the reality of the situation is.

SoCalMtgGuy

bubble butt...

I don't doubt it for a minute.

San Diego is up over 600 properties since last Monday.

15,568 to 16,192 at my last check at ZipRealty.com

Working on fonts and stuff on the other blog...

SoCalMtgGuy

I'm a mortgage broker. I sell a ton of these loans, in fact my brokerage advertises heavily for them by direct mail and television advertising.

For some people it's a great loan. Some people can effectively manage the cash flow by utilizing the monthly payment savings. What we as brokers have to take the initiative on is correctly educating our borrowers on how to use the loan so they don't get into trouble down the road.

This can be done by setting up the loan with a longer recast cap rate, giving the borrower a loan with a higher minimum payment rate so they cannot defer as much, and tieing the loan to a more stable index.

When the shit does hit the fan, the ones to blame will be the greedy, slimy brokers who did not explain the loan effectively and instead focused on their max rebate. And also, the blame will fall on these banks being too aggressive with their mimimum payment rates in a rising interest rate market.

If you look back even 5 years ago...the Pay Option Loan was offering a 2.95 - 3.95% minimum pay rate. When rates began to fall, we ran into a period where the interest only payments on the loan were lower than the minimum pay rate. This opened the flood gates to lower the min pay rate down to rock bottom (there is a loan out there with a .25% start rate, I/O payment). And when rates turned and began to rise....nothing happened to START RATES!! Banks in general where competing for business and were too afraid to lose out to another bank with a lower start rate.

This is another big reason you see the amount of deffered interest increasing so much.

Hindsight may be 20/20 but, you'd think common sense would tell you that the start rates need to move with interest rates.

Post a Comment

<< Home