"We sort of count our equity loans as our income"

Thanks to the reader that e-mailed me this article. I think it is worth taking a look at. I want to hear your feedback if you think they will be an FB or not. http://www.sfgate.com/cgi-bin/article.cgi?file=/gate/archive/2005/12/09/carollloyd.DTL

I think this part of the "story" says it all...but read the whole thing.

Sacco estimates that along with McCook's mother, who has been a silent partner, they've made $1.3 million since they began their buying spree, but all of this is still in equity on their properties. Their monthly reality is more sobering. They have $2.3 million in mortgage debt and negative cash flow that ranges from $5,000 to $15,000 monthly depending on the season.

So how do they pay the bills?

"We sort of count our equity loans as our income," she saysNow THAT is a statement to remember!!! Loans count as income! AMAZING!!! I'd just LOVE to be the investor holding that paper.

-------------------

Now....it's FEEDBACK time!!!

Since I'm writing almost all of my own content and not just copy/pasting from the internet, it takes time. I really appreciate the feedback that people have given me so far. It really motivates me when I know that people are benefitting from reading this blog. It is not easy writing your own content, and it takes time to make it informative, easy to understand, and entertaining. So how am I doing?!?!? I want to hear from you lurkers as well...go ahead and post anonymous comments, or make up a name and post.

That said, what would you like to see next week? I know that people like the FB scenarios, and I will keep them coming. What else is weighing on your mind in regards to the mortgage/real estate markets? I'll do my best to answer your questions.

I hope everybody has a great weekend...I know I will! I look forward to the feedback when I return!

SoCalMtgGuy

38 Comments:

When the music stops, these people will have no chair.

A fool and his money are soon parted.

Socalmtgguy,

Could you do an analysis showing IO and arm by region as a proportion of loans by year. Or is that beyond your ability? I have heard conflictiing #'s on the IO and other exotics. Maybe I am looking in the wrong places. BTW I know someone who works for Cendant and as you may know they are the dominat broker in the southland in CA. He claimed it was approaching 80% but I ahven't seen anything to corroborate it.

not trolly yours,

Metroplexual

I'll see what I can dig up.

It is tough piecing those stats together. Just know this...the higher priced the areas, the more ARMS, I/O, and option arms are being used.

Trying to beat the SoCal traffic this afternoon!

SoCalMtgGuy

Oh yeah,

jenga! Jenga! Jenga!

The only reasonable hope for this speculator's situation is to sell enough to pay down the loans and get to a positive cashflow position -- before prices decline.

Otherwise the borrowing will not work for much longer and the negative cashflow will lead to distress sales. Given the larger equity balance they could hold on for a while. However, this will magnify the problem as declining values and rising debt creates a bigger squeeze. The worst case scenario would be to wait and possibly be forced to sell at the market bottom.

"Some people call it a pyramid, but I don't like to think about it that way"

Would not that which we call a rose, by other name smell as sweet?

I suppose they don't like to think of themselves as FBs, but that doesn't change the facts.

Who writes these people loans? I really don't understand.

May in addition to your FB page, you could start a FL (Lender) page.

Great page - been lurking for a while. And PLEASE, keep up the good work!

Cassandra

Socalmtgguy,

Youyr blog is one of my favorite blogs. As a blogger myselg I totally understand the challenges of blogging,. Keep up the great work.

1) I would like to see more infotmation on what people are doing with the home equity extraction

2)Are the fb despite theirbad financial decisions otheriwse intelligent individuals?

I appreciate your efforts and the originality really shines through, unlike other related blogs that snag and collate other people's efforts, and the interesting reading is only found in the edited comments section.

Keep up the good work!

Yes they will be in FBs hall of shame. This reminds me of the investment scams that promise great returns. You take from one to pay the other while all the along the thing is imploding. The new breed of speculators believe negative cash flow is good. How will they handle depreciating property values? Can you say foreclosure?

They'll have a special section in the FB hall of fame. The women in the article said they don't want to call it a prymid, but it sure is a house of cards.

Started lurking about 4 weeks ago and have been anxiously renting and watching the blood in the streets start to run in the Front Range of Colorado.

~lurking in Fort Collins, CO

can we repost this on www.stupidpeople.com ?

What happens when it is "discovered" that the borrowers lied about tenancy or income or whatever? Will the lenders be "shocked, shocked I tell you to discover gambling on the premises?"

Leverage works both ways of course, multiplies equity exponentially as the market goes up and destroys it exponentially as the market goes down. With no margin for error and no source of income, I would not be betting on these lame horses.

To the anonymous poster from the Front Range: can you post some info regarding the Real Estate situation there? I used to live in Denver. When I left nice loft condos were still going for $180 Grand in LoDo.

Hello! Canada calling!

Loving your stuff. Find it very interesting that our Western Canadian market is lagging yours to some degree. Not for long, though, I think things will change in the coming spring...

Quite fascinating the way Americans are so carefree about taking "risks" to the degree that they do.

This is the best RE story today. I'm sure she's not alone in her situation. I'm wondering if she is to the point that on her new HELOC applications if she counts the actual soon-to-be-credit-line amount as income.

Amount requested: $200,000

Stated Income: $200,000

Profession: HELOC Professional

'Non-recourse' loan exemptions vary by the state.

Non-recourse means the lenders money can be recovered by sale of asset against which it is loaned.

in other words, if the loan is used to buy a home and you mail the keys to the lender in case you cannot make mortgage payments, all the lender can do is to sell the home and get whatever they can. if the sale price is less than the amount owed, they cannot come after your other assets or money in the bank.

This exemption is limited by state laws. for example in Kalifornia, ONLY PRIMARY loan used to by the home in 'non-recourse'. if you 80/20, the 20 is not 'NON-RECOURSE', i believe.

Also if you refinance the 80% even once, you loose the 'non-recourse' protection. that means after this if you send the keys back, they can come and get your car, dog, moeny in the bank, everthing except 401k/iRA.

AGAIN THE ABOVE IS NOT A FINANCIAL ADVICE. Please consult a professional.

socalmtgguy

you have filled a void in the bubble blogs. keep it up.

Great Blog Socal,

I enjoy the humorous originality as well as the stories of FBs.

I've been lurking for a few weeks here and there. Keep up the good work and thanks for having the balls to publish such a great blog.

My interest is twofold.

1. I too "blew it" and actually pulled out of escrow on a property in OC back in 2001 -- I watched with horror and amazement as the bubble kept rising to the point of $600K avg in Orange County - I just didn't understand who were are all the people making $150? Only later did I learn about "Stated Income"...

2. I quit a great job with a major sportswear company a few years ago with dreams of making it big as a loan officer. It proved to be one of the worst mistakes of my life. I had an acquaintance who seemed to be making cash hand over fist along with the rest of his colleagues. I was given an opp to join "the firm" and packed my bags and moved back to "the OC".

Unfortunately, I didn't do my "due dilligence" long enough before quiting my job of the past 4 years. I was pulled in by the excitment and hype of the $$$$ to be made.

Soon after joining what will remain the "un-named firm," I was shocked at the tactics used by the brokers to get people into what seemed to me at the time to be "FB type" loans.

A couple of memorable tactics such these were often heard as I listened in on the brokers (for my training):

For I/O Loan -- "Instead of paying all that money on the principle, you can put it into stocks or investments making 10%" (I remember thinking - yeah right, this guy is already 50% DTI - there is no chance in hell this guy will invest the diff)

For ARM -- "We'll get you in now at 4.75% and you will be able to refinance later when rates go down" (Yeah, right, I'm sure rates will go down from there)

Anyway, I didn't last but 2 months in that environment. I couldn't handle helping people become FBs. I wanted to sleep well at night.

(Caveat: I know there are good loan officers out there - but unfortunately, it seems the opportunistic are the vast majority and are helping the market bubble-up like never before)

Anyway, It was a costly mistake and took me several months to get back to regular full time employment at near my previous wage - around 70K.

Keep up the good work!

Socalmtgguy,

Anonymous but, Thinking of a name.....

Have been lurking here and decided to post since you asked and wanted to show some appreciation for your time and work. Great blog by the way.

I work in Irvine and the people i work with don't seem to believe in the bubble. Just had a coworker on Tuesday tell me that I needed to buy since IT NEVER GOES DOWN! and since he believes Irvine is the new Downtown OC metropolis that will be like SF or NY soon but, again I beg, I ask where are all of these people coming from to buy everything down there......must be lots of homeless people out there these days I guess. I was then told by this coworker that everyone wants to live in IRVIVE and my rebutal was WOW, I huess no one wants to live in any of the other "EVERYONE WANTS TO LIVE HERE TOWNS". Anyhow, thanks again for your stories and hard work.

Thinking of a name.

Can you explain some of the loan products used? I just sold my house to a couple, who are financing the entire $790K with a 30-yr 5-2-2-1-x ARM, what does that mean? I think the rate on the lender's sheet says 6.5%. Are these people FBs? I sure hope their loan goes through - they are prequalified to much more. I'm getting out at the top.

socalmtgguy,

I just wanted to say that I love your blog! It's weird to read all of the AFB stories, since I work with a guy who helps his wife secure marginal mortgage loans on the side like the ones you mention. The stories he tells me about some of his FBs are really close to the stories posted here. One of his FBs got an I/O on a house and had to refinance to a neg AM before their first payment was due thanks to some "emergency..." Crazy stuff!

I've been sighing in relief ever since my husband and I dumped our house in June of this year-- a couple of weeks before houses started sitting on the Sonoma County market...

Anyway, thanks for a fabulous blog! I'd been wondering for a long time how some of my coworkers in lesser paying jobs managed to afford to buy higher priced houses than our old Sonoma clunker, but your blog has made that really clear. Thanks so much for your time :-)

Desi Dude's analysis of California law relating to the inability of a lender to go after you is inaccurate. The key when we are talking about non-recourse centers upon two possibilities. The first is seller carry-back financing. This paper is non-recourse, leaving the seller with the sole option of foreclosing on the property. The second relates to purchase money financing of residential real estate. Again it is non-recourse. So, when you buy a residence, and it is your typical 80/10/10 with a seller 10% carryback, you have no personal liability on either loan. When you buy a commercial building and there is a seller carryback of secured financing, again no personal liability as to that secured seller financing.

Note however that foreclosures can have a negative impact on your credit score.

my take was about home loans on residential purchases-owner occupied.

It was not supposed cover anything else.

put it simply.

a)loan to buy your home is non-recourse-- purchase loan

2)If you refinance, you loose non-recourse protection.

AGAIN THIS IS NOT A LEGAL ADVICE, CONSULT a PROFESSIONAL

from www.wwlaw.com

Tax Consequences: NON-RECOURSE LOANS

Non-recourse loans include typical California purchase loans used to buy an owner occupied residence of up to 4 units.

State Law protects borrowers from personal liability on a purchase mortgage for a home which they occupy at purchase. (If the borrower later converts the home to rental, he is still protected.) The State has put the risk on the lender; the most a lender can do is take back the house. This law applies to properties of up to 4 units, and applies only to loans used to purchase the property.

Purchase loans include bank loans and seller carrybacks.

Some cases allow the same protections for refinances IF there is no cash paid out to the borrower, or if any cash paid out is used for property repairs or improvements.

If the loan falls within this statutory protection, it is a non-recourse loan. Other loans may be non-recourse by their terms.

[Special rules may apply to VA and FHA loans.]

The tax consequences of foreclosure, deed in lieu of foreclosure, or short sale on a non-recourse loan are simple: the property is taxed as if it were sold for the total outstanding amount of the loan (or sales price, if higher). Taxability of the gain and deductibility of the loss depend on the nature of the property.

Well for Financial Planning in Southern CA, go to www.vfos.com They specialize in 3 million+ net worth clients, with all these crazy investment plans and "tax reduction" tools. Pretty much if you are rich, they keep you rich. =)

argh! messed up on my html www.vfos.com

Karen,

Congrats on selling your house! And for getting over $500K for it :-) How does it feel?

Ours really was a clunker-- we found out at the inspection that we were a year away from having to replace the roof, etc. Plus, my husband thought of the house as his "project" which never really got finished and never really gave me the chance to relax when I got home after a long commute. I had about a four hour a day round-trip commute to San Fran, and it was just awful. I was so glad to see the thing go ;-) Plus, I don't know if you had the same feeling I did about having a mortgage-- for me, the 30 year fixed huge (to me) payment ($2000.00) and huge debt (well, not that huge, really... My husband bought the house at 380K) hovering over my head felt like I was holding the weight of the world. Really, tempermentally, I'm much happier renting. We were far from being FBs, but it was still unnerving to me.

We still would head to the East Bay at least once a month just because there was nothing to do in Santa Rosa or the environs. We managed to sell the house for about $550K less closing costs. We're now renting in the East Bay, and the commute is fabulous! I walk to BART and am on the train for a mere 35 minutes. It really is heaven ;-)

We have a financial planner but weren't in any real position to do anything with the plan until July. And we're a bit lazy, so one of these days... ;-) But the feeling of urgency is off and I can breathe easily again.

Thanks for the comments everybody!!

I'll try to answer a few quick questions that were posted...

- bwrs are taking cash out for everything imaginable. Mortgage payments, other properties, cars, vacations, etc. What they SAY they are taking the money out for are: debt consolidation or home improvement.

- yes, "smart" people are being caught up in this as well. after all, they see people that make less money buying 500k houses, so they feel if "they" can afford it on less money, then they will be fine.

- the lenders won't be shocked. they sold the many of the loans...and they knew a lot of it was BS when they made the loans. See my post with the "stop mortgage fraud" pic at the top.

That's all for now...need to get some sleep.

SoCalMtgGuy

Hi, I'm a lurker and I get the most enjoyment from your stories about people getting in way over their heads.

The only suggestion I can think of is if you hear of anything related to people getting in trouble due to higher heating prices this winter.

Thanks for all your hard work!

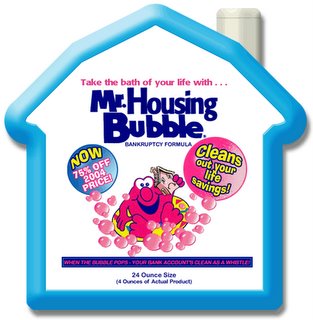

Thankyou so much for this site. I have been so depressed over the impossibly high cost of housing and the way it's been going up up and up-er. Not only do the things I read here give me hope that it may soon be going down down and down-er, I even get to laugh about it sometimes ( the bubble bath ad is T-riffic). God Bless All.

The original "generic" link to that story now points to a different story.

This oughta get you to the original article now.

Thanks,

I'll fix the link when I get a chance!

SoCalMtgGuy

Great blog!

I have to say, after reading through this blog my old paid-for house, old paid-for furniture, and old paid-for pickup are looking really good!

www.chbo.biz would be great for investors with multiple loans looking for answers. This program gives you the oppurtunity to be your own property manager and advertise to business travelers. This is a great concept, it worked for me. Check the website out

Does anyone know of a company called The Milli Group? They are nation-wide but have a strong presence in California - any info would be appreciated.

yAnother end to the bubble might come from two changes in consumer attitude. It isn't scientific but it is possible for markets incuding housing to just plain old get exausted. SUV sales are still off 30-60% even though the oil price spike is a memory. Then there are the other consumers, the buyers of MBSecs. I find it likely that they won't want any more paper at any price. This doubly worries me as we discussed earlier how lots of seemingly ordinary commercial paper is merely laundered MBSecs. wow gold opportunity! A careful analysis of what assets or supports are actually behind the loan market would probably dictate caution and lightening up on anything with exposure.

I am too later here,

However guys, Is that work out? I am afraid whether this may be scam or not, anyone here had good experience here

Expenses might pop up anytime and can make the situation serious and unbalanced. Thus, by considering these loans one can easily get the cash in time and fulfill the demands. for more information about Debit Card Loans

visit

http://www.debitcardpaydayloans.org.uk/

In principle, a good happen, support the views of the author

Equity loans are debt not income.

Post a Comment

<< Home